California wine country is a big draw for luxury travelers, according to a new report from the Wine Institute.

According to an online survey of more than 2,000 U.S. adults who had recently visited California wine country, nearly 50 percent stayed in luxury hotels (48.3% four-star, 25.6% five-star) versus a national norm of about 15 percent staying in the equivalent of five-star properties. Visitors use a variety of resources in deciding which regions and wineries to visit and most often rely on word-of-mouth recommendations (62.3%) and general Internet searches (43.9%). While most California wine region trips are driven by leisure vacations (32.6%) or weekend getaways (26.2%), nearly one in ten trips (8.5%) is an add-on to a business or convention trip.

The Wine Institute commissioned the study with support from a USDA grant. It was conducted by Destination Analysts of San Francisco and was fielded in late 2016. In the study, a California wine tourist was defined as someone who had visited a California wine region for leisure within the past three years to capture both high-involvement and casual wine tourists.

Other highlights from the report:

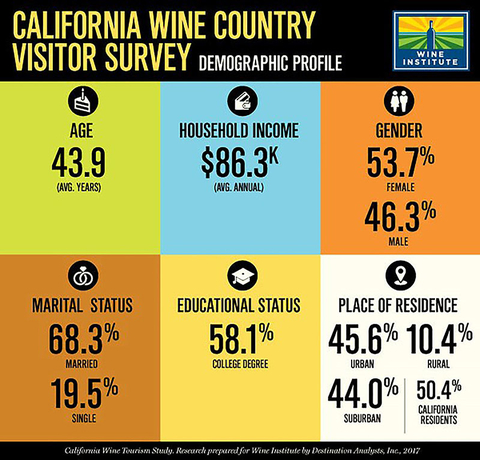

The profile of the California wine country visitor is consistent with wine drinker demographics. The average age of visitors to California wine country is 43.9 years old, with Baby Boomers accounting for 39.5 percent, Gen Xers 21.9 percent and Millennials 36.1 percent. The majority of visitors are married (68.3%), resides in an urban (45.6%) or suburban (44%) area and are slightly more likely to be female (53.7% vs. 46.3%). California wine region visitors are well-educated and have higher incomes compared to the national average leisure traveler.

More than 70 percent of California wine country visitors surveyed drink wine at least once a week with 36 percent drinking wine several times a week and nearly 20 percent imbibing daily. Nearly 60 percent consider wine "important" or "very important" to their lifestyles and see themselves as "very knowledgeable" about the beverage. About 30 percent have been a member of one or more wine clubs in the past three years, suggesting the potential for growth in wine club sign-ups but also serving as a reminder that while many wine tourists may not join clubs they do purchase wine from other outlets and recommend them to others based on winery visits.

The vast majority of California wine visitors were highly satisfied with their trips and extremely likely to recommend the regions they visited to others. Over 70 percent of surveyed travelers preferred the California wine region they visited to out-of-state wine regions. About 73 percent found that the California wine region visited provided a "better" or "much better" experience. Residents from outside of the state gave the California wine experience higher ratings than those from California. Nearly 79 percent of travelers from other states gave a top score (8 or above on a 10-point scale), compared to 72 percent of Californians. Finally, visits to a wine region greatly increased the likelihood of purchasing wines from that region when travelers returned home, especially among out-of-state visitors (64% very likely to purchase).

Word of mouth was by far the leading source of information (62%) for deciding what regions to visit, followed by general online search (44%), suggesting that social media and search optimization are very important communications channels for wineries and wine regions. Interestingly, wine magazines edged out travel magazines as an information source, while printed wine region maps came out higher than both (not everything has gone digital).

The survey asked visitors to respond to a series of questions on regions they had visited in the past three years. Based on an analysis of responses, visitors to less well-known or remote wine regions of the state most closely mirror the high-involvement wine drinker versus visitors to more well-known regions. A higher percentage of visitors to lesser known regions regard wine as important to their lifestyles, are members of wine clubs and consider themselves knowledgeable about wine. This likely reflects both the dedication of high-involvement wine country visitors to seeking out new regions and a larger number of casual visitors to well-known regions – areas of opportunity for both wineries and regions.

Related Stories

Stats: Europe Top Destination Region for U.S. Travelers

Stats: 28 Percent of Americans to Take Fall Trip, Says AAA

Stats: Airline Tickets Lead “Substantial Purchases” by Year’s End