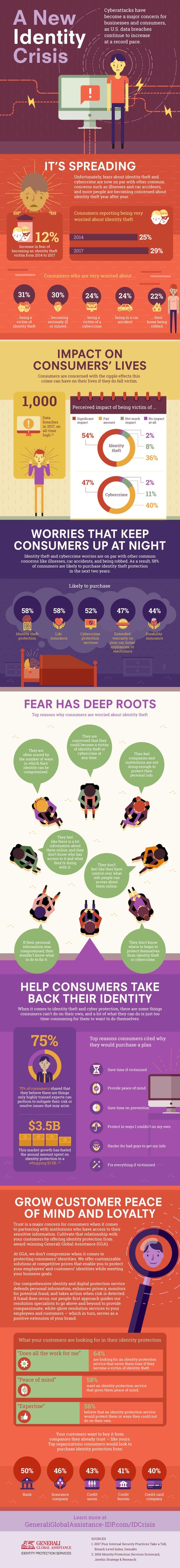

Thirty-two percent of U.S. consumers fear becoming a victim of identity theft within the next five years, up from 20 percent in 2014, according to a new study by Generali Global Assistance.

The study explores the ever-expanding threat posed by cyberattacks and identity theft, and more specifically the impact on consumers. Data breaches in the United States continue to increase at a record pace and are predicted to reach an all-time high of over 1,000 in 2017, according to Gemalto. As a result, worry about identity theft and cybercrime is now on par with other common concerns such as illnesses and car accidents, and more people are becoming concerned about identity theft year after year. For example, 31 percent of U.S. consumers are very worried about being a victim of identity theft, while only 22 percent are very worried about their home being robbed. Ninety percent of consumers believe that experiencing identity theft or fraud would have a fair to significant impact on their lives.

In a written release Paige Schaffer, president and COO of Generali Global Assistance's Identity and Digital Protection Services Global Unit, said, "Fear of becoming an identity theft or cybercrime victim is on the rise, and consumers are concerned with the impact these crimes can have on their lives. With 2017 on pace to reach an all-time high of reported data breaches, businesses and consumers alike need to be more prepared than ever to mitigate associated risks."

Identity theft and cybercrime worries are on par with other common concerns such as illness, car accidents, and being robbed. As a result, 58 percent of consumers are likely to purchase identity theft protection in the next two years. For comparison, the same percentage (58%) are likely to purchase life insurance in the next two years, while only 47 percent of consumers plan to purchase an extended warranty for their car. The annual amount spent on identity protection has risen to a whopping $3.5 billion, according to Javelin Strategy & Research. Reasons that consumers cited for potentially purchasing identity protection include saving time if victimized by identity theft, peace of mind and the resolution services offered by identity protection organizations. Additionally, consumers indicated that they would want to buy identity protection from companies they already trust, including banks, insurance companies, credit unions, credit bureaus or credit card companies.

Ms. Schaffer concluded, "Peace of mind is a major factor influencing consumers to purchase identity protection plans, and 75 percent feel that only highly-trained experts can mitigate risks and resolve issues."

Source: Generali Global Assistance

Related Stories

Stats: 71% Think Planes Should Have “Plus Size Zones”

Stats: Business Flights at Highest Level Since 2008