ForwardKeys has analyzed recent trends in intra-European flight bookings for travel in July and August, and changes in seat capacity. The air-ticketing data company took closer look at air traffic disruption resulting in flight cancellations, as airports burdened with staff shortages struggle to cope with surging demand.

The result? Data reveals that a dip in consumer confidence, which commenced in the last week of May, swiftly worsened as last-minute bookings in the week running up to July 10 were down by 44 percent, compared with 2019 levels. Bookings from Amsterdam were down by 59 percent and from London by 41 percent.

The recent level of disruption to travelers’ schedules is well illustrated by a jump in the ratio of partial cancellations and modifications to total bookings. From May 30–July 10, it has almost tripled from 13 percent prior to the pandemic (in 2019) to 36 percent this summer.

The collapse in last-minute bookings and the increase in cancellations and modifications is making a substantial dent in the travel industry’s outlook for the summer. As of May 30, total intra-European flight bookings for July and August were 17 percent behind 2019 levels; however, seven weeks later, on July 11, they were 22 percent behind, a slowdown of 5 percentage points.

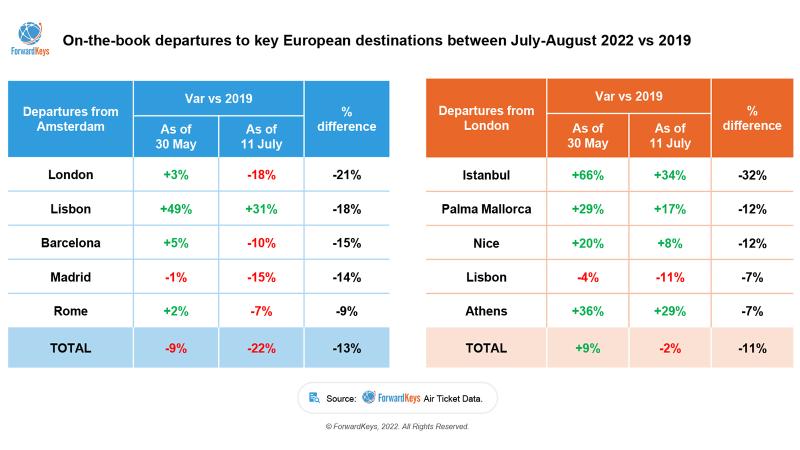

The relative slowdown has been far worse for Amsterdam and London. At the end of May, July-August bookings from Amsterdam were nine percent behind 2019 levels and from London were nine percent ahead. They have since fallen back to 22 percent and two percent behind respectively, which equates to a 13 percentage-point slowdown in bookings from Amsterdam and an 11 percentage-point slowdown from London.

The destination suffering the greatest relative setback in its summer outlook as a result of the slowdown in last-minute bookings from Amsterdam is London. Bookings have slowed from three percent ahead of 2019 levels in the fourth week of May to 18 percent behind on July 11, which represents a drop of 21 percentage points. On the same metric (percentage point drop), it is followed by Lisbon (18 percent), Barcelona (15 percent), Madrid (14 percent) and Rome (9 percent). Taking the same approach with London, the most affected destinations are Istanbul, to where bookings have fallen by 32 percent; Palma Mallorca and Nice (12 percent each) and Lisbon and Athens (7 percent each).

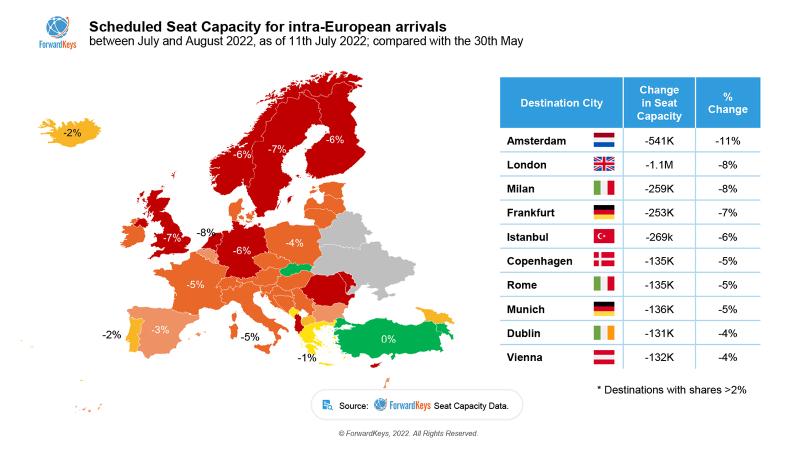

The 5 percentage-point slowdown in intra-European bookings from the last week of May to July 11 is mirrored by a similar reduction in airline seat capacity over the same period. ForwardKeys reveals that scheduled intra-European seat capacity has witnessed a reduction of 5 percent across the continent, with Amsterdam and London experiencing the largest reductions, at 11 percent and eight percent respectively.

Olivier Ponti, VP Insights, ForwardKeys, said: “One can think about this summer both positively and negatively. On the upside, it is encouraging to see a strong resurgence in demand following the pandemic, with summer bookings in May surging ahead of 2019 levels. That was excellent news for the travel, tourism and hospitality industries, which badly need the business; however, things have come back so fast that airports and airlines have struggled to cope, which is causing chaos for the travelers whose flights are affected. While we can be confident that airports will eventually succeed in recruiting the staff they need, there are a few trends that give cause for concern. First is the increase in the price of oil, fueled by the war in Ukraine, which will increase the cost of flying. Second is inflation (also a consequence of the war), which will likely leave most travelers less able to afford the fare. Third, the increased level of disruption is substantially dampening demand, as we are seeing a dramatic slowdown in last-minute flight bookings, plus an increase in cancellations. At the end of May it seemed we would see an exceptional summer for travel within Europe; but now it is more likely to be just a good one.”

Source: ForwardKeys

Related Stories

Hotel Guest Satisfaction Drops as Travel Volume, Room Rates Rise

Half of Americans Planning At Least One “Micro-Cation” This Year

Tourism to Contribute $2.6 Billion to U.S. GDP Over Next Decade

Stats: Summer Vacations Among Cutbacks Amid Inflation Concerns